China's Property Dilemma and Economic Woes: A News Analysis

China's Q2 GDP growth slowed to 4.7% y/y, driven by a declining housing sector, despite strong exports and manufacturing, highlighting economic recovery challenges

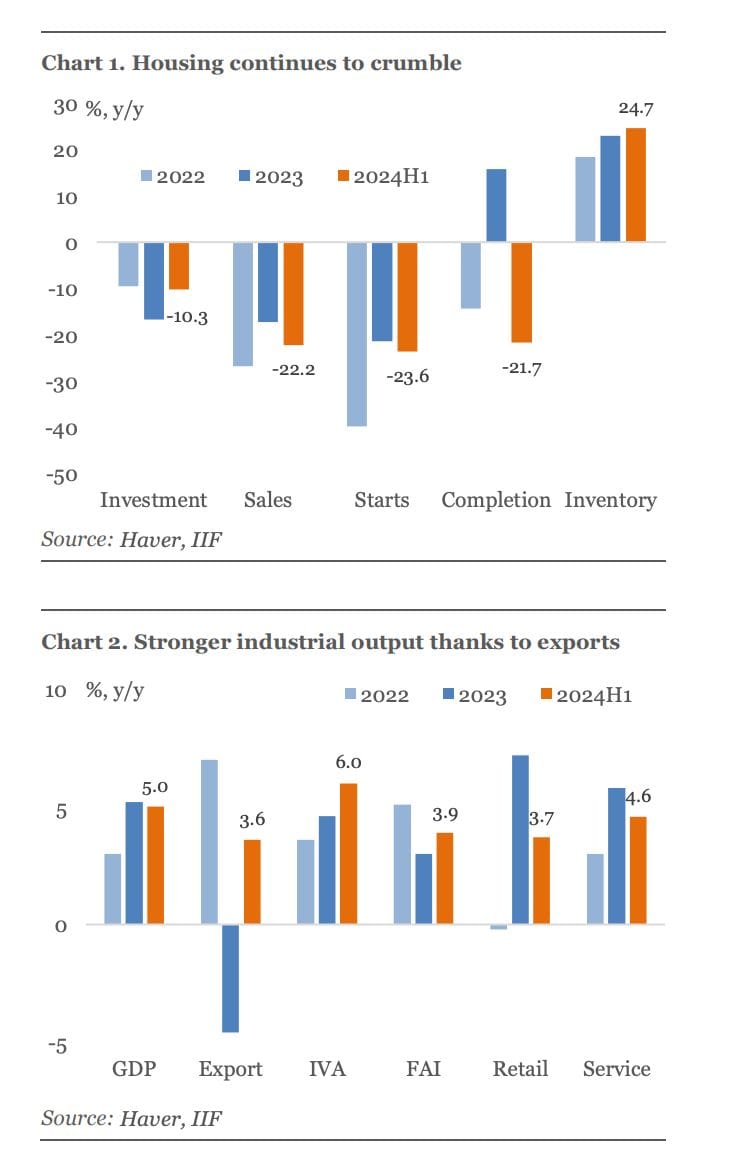

China's Q2 GDP growth slowed to 4.7% y/y, down from 5.3% in Q1, mainly due to a struggling housing sector. Home sales and starts fell sharply in H1, with completions also plummeting.

Despite low mortgage rates and eased purchase restrictions, the housing market shows no recovery signs. Manufacturing remained robust thanks to strong exports, but retail sales and services weakened amid housing woes and a soft job market.

The People's Bank of China (PBoC) has been slow to cut rates further, and local governments are hesitant to increase borrowing, hindering economic recovery efforts. More policy support is crucial to boost growth.

China: Weak Q2 GDP Growth Confirms Downside Risks

In a recent investor tour note, Gene Ma and Phoebe Feng from the Institute of International Finance (IIF) highlighted their concerns about China’s economic growth. The Q2 data confirmed these fears, with GDP growth slowing to 4.7% y/y from 5.3% in Q1. Sequentially, GDP slowed to 0.7% q/q, largely due to weak housing activity.

Housing Sector Continues to Crumble

China’s housing sector remains in decline, with home sales and housing starts decreasing by 22.2% and 23.6% in H1, respectively. Home completion also plummeted by 21.7%. Despite low mortgage rates and the removal of purchase restrictions, the housing market shows no signs of recovery.

Robust Manufacturing Amid Export Strength

Manufacturing remained a bright spot, driven by strong exports. Industrial value-added growth accelerated, particularly in advanced manufacturing and equipment. The secondary sector's GDP grew by 5.8% y/y in H1, though fixed asset investment slowed to 3.9% y/y due to declines in real estate and infrastructure investment.

Retail and Services Suffer Amid Economic Struggles

Retail sales and services weakened significantly, impacted by housing woes, a soft job market, and deflationary expectations. Weak housing sales hurt related sectors, with tertiary sector GDP slowing to 4.2% in Q2.

Policy Responses Lagging Behind

The People's Bank of China (PBoC) has been slow to respond to the economic slowdown. Despite a cut in the 5-year loan prime rate, there have been no other significant interest rate cuts since October. New total credit and bank loans declined in H1, and money supply growth hit record lows.

Fiscal Policy and Economic Outlook

China’s large fiscal deficit budget for 2024 has not been fully executed. Local governments, already heavily indebted, are reluctant to increase borrowing. Local government debt issuance in H1 was only 40% of the quota. Despite the success in manufacturing, particularly green technologies, below-potential growth has led to depressed prices, business profits, and job opportunities.

The Need for Policy Support

To restore China’s growth potential, more policy support, particularly lower interest rates, is needed. However, achieving this without causing further resource misallocation or fundamentally changing China’s economic model seems challenging. The upcoming Party's 3rd Plenum and the Politburo economic policy meeting in late July may provide further insights.